NOTICE OF PASSING OF MUNICIPAL-WIDE DEVELOPMENT CHARGES BY-LAW

TAKE NOTICE that the Council of the Township of East Garafraxa passed municipal-wide Development Charges By-Law 39-2024 on the 22nd day of October 2024 under section 2 (1) of the Development Charges Act, 1997, S.O., 1997 c. 27 (Act), as amended.

AND TAKE NOTICE that any person or organization may appeal to the Ontario Land Tribunal (OLT) under section 14 of the Act, in respect of the development charges by-law, by filing with the Clerk of the Township of East Garafraxa on or before the 2nd day of December 2024 a notice of appeal setting out the objection to the by-law and the reasons supporting the objection.

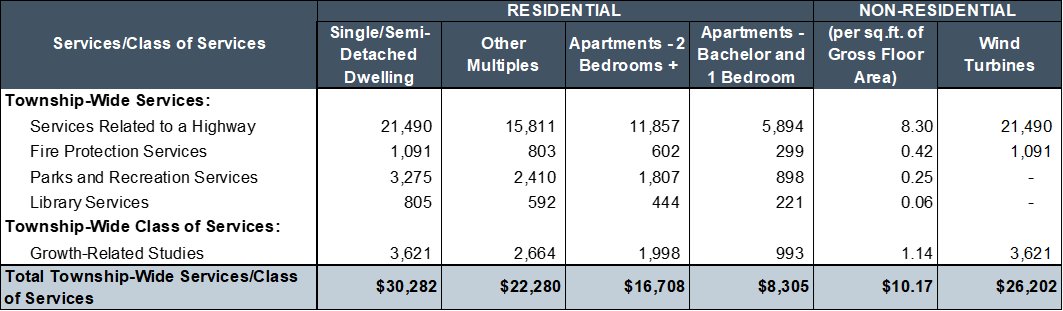

The schedule of development charges imposed by the by-law, which will come into effect on October 31, 2024, is as follows:

SCHEDULE B

By-Law No. 39-2024

No key map has been provided as the by-law applies to all lands located within the Township of East Garafraxa.

A full copy of Development Charges By-Law 39-2024 is available on the Township website and at the Township Administration Office, 065371 Dufferin County Road 3, Unit 2, East Garafraxa, ON L9W 7J8, during regular business hours (weekdays from 8:30 AM to 4:30 PM) excluding statutory holidays.

DATED at the Township of East Garafraxa, Ontario, this 25th day of October 2024.

Jessica Kennedy, Clerk

Corporation of the Township of East Garafraxa

226-259-9400 ext. 204 clerks@eastgarafraxa.ca

Link to Notice of Passage Dated October 25, 2024

Notice of Passing and Addendum Report

NOTICE OF PASSING OF MUNICIPAL-WIDE DEVELOPMENT CHARGES BY-LAW AMENDMENT

TAKE NOTICE that the Council of the Township of East Garafraxa passed municipal-wide Development Charges By-Law Amendment No. 34-2024, amending By-Law 32-2019, being a By-Law for the Imposition of Development Charges, on the 27th day of August, 2024 under section 2 (1) of the Development Charges Act, 1997, S.O., 1997 c. 27, as amended.

The purpose of By-Law Amendment No. 34-2024 is to delete the expiry date from By-Law 32-2019, providing additional time for Council and the public to review the available options before adopting a new By-Law.

The schedule of Development Charges imposed by By-Law 32-2019, which came into effect on August 31, 2019, as indexed annually, remains in effect.

For more details, please refer to the Development Charges - Township of East Garafraxa page on the Township's website, where you can find the Watson & Associates Economists Ltd. 2024 Development Charges Background Study Report dated June 27, 2024 (Revised July 16, 2024), and the corresponding Addendum Report dated September 6, 2024

Please review the Addendum Report for information on the anticipated timeline for consideration by Council and the passage of a new Development Charges By-Law.

Dated this 6th Day of September 2024

Jessica Kennedy, Clerk

Corporation of the Township of East Garafraxa

226-259-9400 ext. 204, clerks@eastgarafraxa.ca

Notice of Public Meeting

On Tuesday, July 23, 2024 the Council of the Township of East Garafraxa will hold a Public Meeting, pursuant to section 12 of the Development Charges Act, 1997, as amended, to present and obtain public input on the Township’s proposed development charges (D.C.) by-law and underlying background study.

All interested parties are invited to attend the Public Meeting of Council and any person who attends the meeting may make representations relating to the proposed D.C. by-law and background study. The meeting is to be held virtually/electronically on Tuesday, July 23, 2024 at 4:00 p.m. Zoom registration details can be found on the Township website in the calendar under the public meeting date. Please contact the Township Clerk for details on how to join and/or participate at the virtual meeting.

In order that sufficient information is made available to the public, the background study is being made available on the Township’s website www.eastgarafraxa.ca on June 27, 2024. Copies of the proposed D.C. by-law and the background study are also being made available on June 27, 2024 from the municipal Clerk at the Township Administration Office located at 065371 Dufferin County Road 3, East Garafraxa.

Interested persons may express their comments at the Public Meeting or in writing, addressed to the municipal Clerk, at the above noted address, or by email clerks@eastgarafraxa.ca by 4:30 p.m. on July 22, 2024, and such written submissions will be placed before Council for the meeting.

Dated this 27th Day of June 2024

Jessica Kennedy, Clerk

Corporation of the Township of East Garafraxa

226-259-9400 ext. 204 clerks@eastgarafraxa.ca

Background Study

The Watson & Associates Economists Ltd. Background Study Report dated June 27, 2024 (revised July 16, 2024 (to correct the Public Meeting Date)) provided herein represents the Development Charges (D.C.) Background Study for the Township of East Garafraxa required by the Development Charges Act, 1997, as amended (D.C.A.). The report has been prepared in accordance with the methodology required under the D.C.A. The contents include the following:

- Chapter 1 – Introduction and overview of the legislative requirements of the D.C.A.;

- Chapter 2 – Review of the Township’s present D.C. policies;

- Chapter 3 – Summary of the anticipated residential and non-residential development for the Township;

- Chapter 4 – Approach to calculating the D.C.;

- Chapter 5 – Review of the historical level of service, increase in capital needs, identification of future capital costs to service the anticipated development, and related deductions and allocations;

- Chapter 6 – Calculation of the D.C.s;

- Chapter 7 – D.C. policy recommendations and rules; and

- Chapter 8 – By-law implementation.

D.C.s provide for the recovery of growth-related capital expenditures from new development. The D.C.A. is the statutory basis to impose these charges. The methodology required to determine the charges is detailed in Chapter 4; a simplified summary is provided below.

- Identify amount, type, and location of the anticipated development;

- Identify the increase in need for service to accommodate growth;

- Identify capital costs to provide services to meet the needs;

- Deduct:

- Grants, subsidies, and other contributions;

- Benefit to existing development;

- Amounts in excess of 15-year historical service calculation; and

- D.C. reserve funds (where applicable);

5. Net capital costs are then allocated between residential and non-residential development types; and

6. Net costs divided by the anticipated development to provide the D.C.